Are Covid Masks Taxable In Pa

Jun 26 2021 at 800 AM. Now theres a new public health threat.

How To Make Alternative Face Masks And Shields When Other Personal Protective Equipment Is Unavailable Department Of Public Health City Of Philadelphia

The South Carolina Department of Revenue DOR has announced that due to COVID-19 taxes administered by the DOR or tax returns filed with the DOR other than income taxes that are due between April 1 2020 and June 1 2020 are now due on.

Are covid masks taxable in pa. The Pennsylvania Department of Health reported 304 additional coronavirus cases on Friday. Offers early property taxrent rebates to qualifying seniors and people with disabilities. On Wednesday the Pennsylvania Department of Health reported 87242 coronavirus cases since the coronavirus pandemic began and 6687 deaths.

Likewise toilet tissue is not taxable but you will pay sales tax on a box of tissues. Created November 17 2020. Additionally Act 1 of 2021 SB 109 that was signed by into law by the Governor specifically states the payments are not taxable under Pennsylvanias Tax Reform Code.

Code 521 and 581 relating to purchases of medicines medical supplies medical equipment and prosthetic or therapeutic devices. Homeowners renters and people with disabilities could be getting cash in their pockets starting this week thanks to a new bill that Governor Wolf signed into law today authorizing the early distribution of rebates through Pennsylvanias property tax and rent rebate program. I think its beautiful to be able to see to.

COVID-19 in Pennsylvania COVID is tough but Pennsylvanians are tougher. Updated June 28 2021 The Updated Order of the Secretary of the Pennsylvania Department of Health Requiring Universal Face Coverings was lifted on June 28 2021. If you havent already you can ditch your.

To help people facing financial challenges resulting from the COVID-19 pandemic the Department of Revenue is providing many taxpayers with increased flexibility with regard to their tax obligations. Grocery Convenience Store Employees Grocery and convenience store workers are considered essential to ensure an accessible food. The seven-day moving average of newly reported.

General Laws Chapter 64H. Pennsylvania will be taking its last step towards normalcy when the mask mandate officially lifts on Monday. 2730 The Department of Revenue is hereby giving notice to the public in accordance with the provisions of 61 Pa.

Its important that everyone takes precautions to slow the spread of COVID-19 and get a COVID-19 vaccine. As of Wednesday Philadelphias Department of Public Health has reported 26257 cases and 1609 deaths. 2020 Act 24 the Pennsylvania COVID-19 County Relief Block Grant Program and the federal Coron-avirus Aid Relief and Economic Security Act CARES Act Coronavirus Relief Fund provisions funds can be used to cover working capital costs necessary to maintain operations during the COVID-19 public health cri-sis.

There is no longer a statewide requirement to wear masks. There are 1212561 positive COVID-19 cases in Pennsylvania. Juice is food but.

Check out the COVID-19 Vaccine Dashboard to track the progress of vaccine distribution in Pennsylvania. The COVID-19 vaccine can keep you from getting COVID-19 and may even lessen symptoms if you do contract the virus. Relief for Taxpayers During COVID-19 Pandemic.

The goal is to help Pennsylvania taxpayers and citizens impacted by the pandemic. Purchases of apparel fabric are also not subject to tax. Help us report on the pandemic.

Unless the IRS says otherwise consider face masks. What we can do. No not for non-health-care professionals.

Heres what the mask. Pennsylvanias mask rule expires Monday. Waiver of Penalties on Accelerated Sales Tax Prepayments Pa.

Are you on the front lines of the coronavirus. And publication of the list of taxable and exempt tangible personal. Explore in-depth Pennsylvania data.

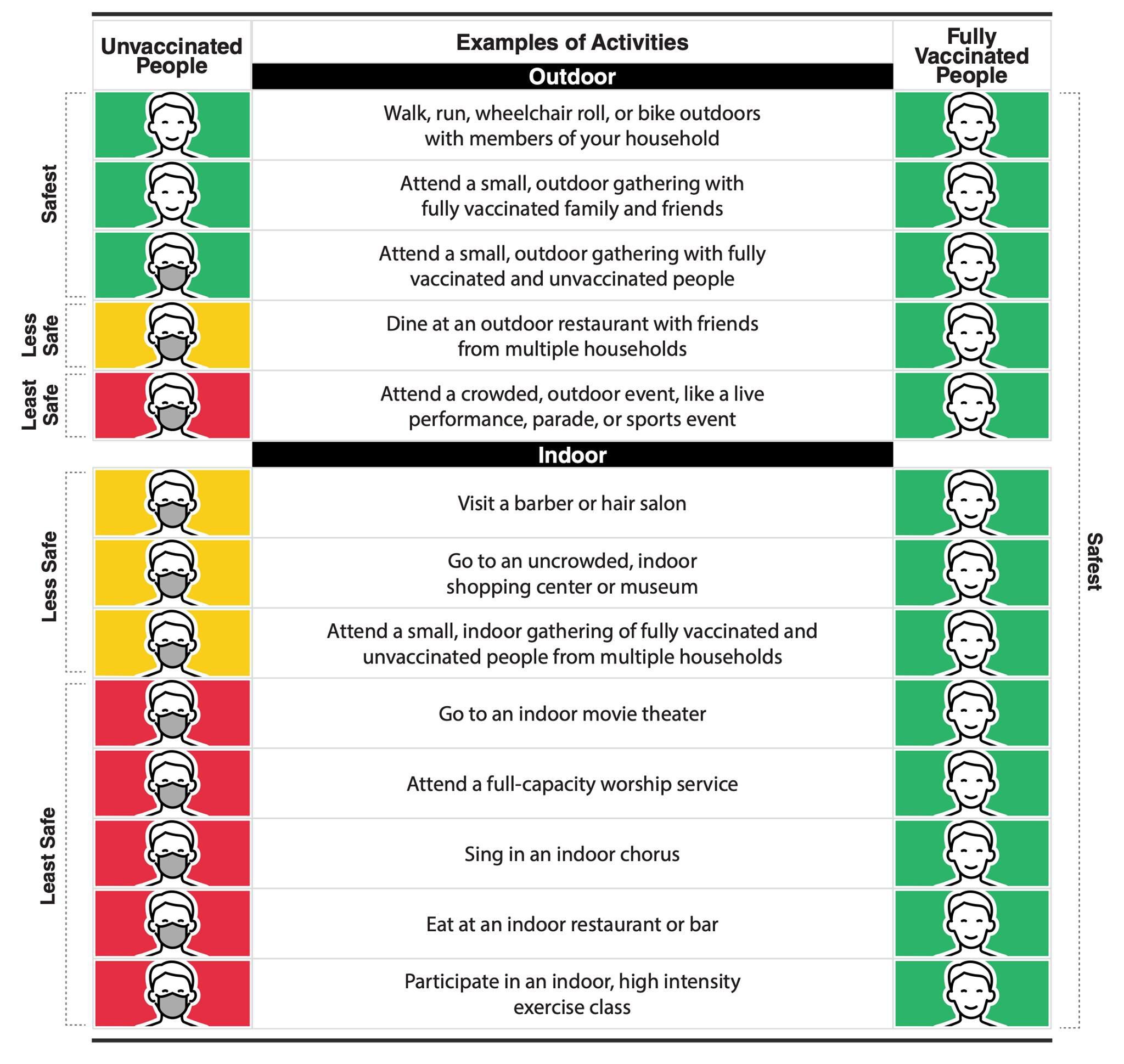

The payments are being distributed as part of federal economic stimulus legislation that has been passed in response to the COVID-19 pandemic. Pennsylvania sales tax is not imposed on certain medical equipment or supplies such as disposable surgical masks or ventilators In Pennsylvania the state sales tax is 6 and in Allegheny. We think its worth repeating that the Governor discourages residents from using medical grade masks indicating those should be reserved for medical personnel first responders and others on the front lines of the coronavirus pandemic.

Provide masks for employees to wear during their time at the business and make it a mandatory requirement to wear masks while on the work site except to the extent an. In the complaint attorneys argue these retailers disregarded the April ruling that protective face masks that are sold at retail are exempt from Pennsylvania sales tax during the emergency. If you are a regular civilian you should assume your face mask is not tax-deductible.

For example pet food is subject to sales tax while flea and tick shampoo for pets is not. DEPARTMENT OF REVENUE Notice of Taxable and Exempt Property 28 PaB. Vaccines are safe and are the best way to protect yourself and those around you from serious illnesses.

Pennsylvania then followed suit automatically adopting new relaxed federal guidance on mask-wearing for people who are vaccinated. Of Rev 03192020 South Carolina. Together we can make a difference slow the spread of the virus and save lives.

Updated 405 pm. Updated Order of the Secretary of the Pennsylvania Department of Health Requiring Universal Face Coverings Frequently Asked Questions. The Morning Call.

Pennsylvania Covid 19 Ppe Supplies Business 2 Business B2b Interchange Directory Pa Department Of Community Economic Development

Mask Guidelines Rules Still Vary From State To State Store To Store 6abc Philadelphia

Pennsylvania Covid 19 Ppe Supplies Business 2 Business B2b Interchange Directory Pa Department Of Community Economic Development

Does Wearing 2 Or 3 Masks Offer Better Protection Against Covid 19 Spread Goats And Soda Npr

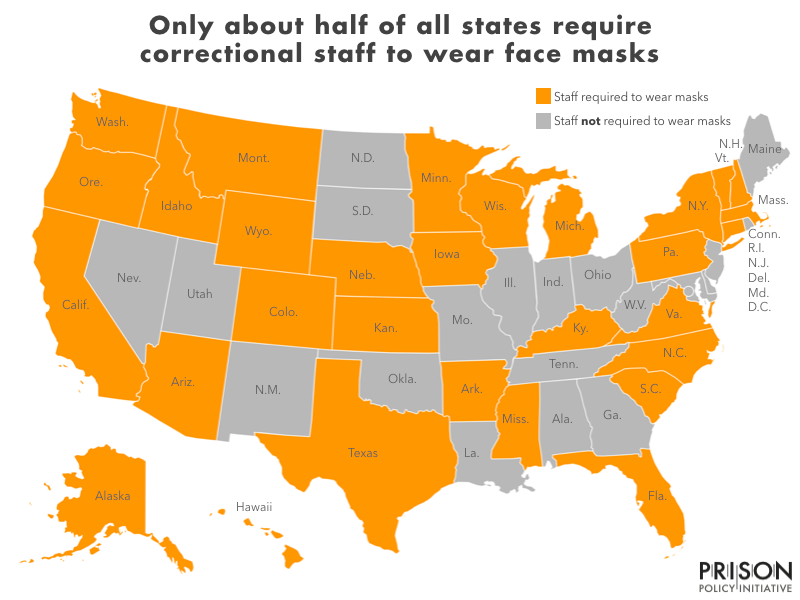

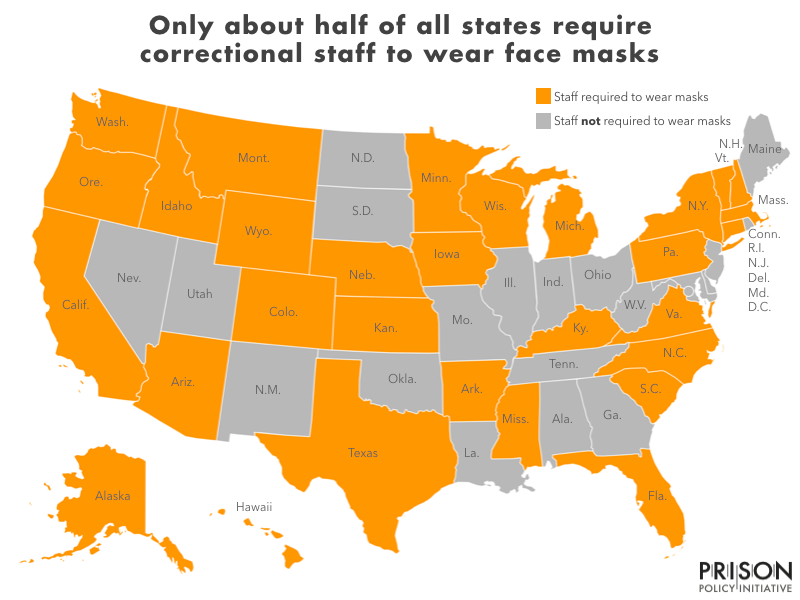

Half Of States Fail To Require Mask Use By Correctional Staff Prison Policy Initiative

Stats Of The Pa Pandemic One Week Until Mask Order Is Lifted

Who Wears A Mask And Why Here S What The Data Say And What We Should Do About It Commentary Baltimore Sun

Overview Bucks County Opportunity Council Inc

Pa Updates Mask Rules To Match Cdc While Philly Expects Decision Within Days N J To Continue Indoor Mask Mandate

Pa Updates Mask Rules To Match Cdc While Philly Expects Decision Within Days N J To Continue Indoor Mask Mandate

Covid 19 Information Center For The City Of Hermitage Hermitage Pa

Covid 19 Info Washington County Pa Official Website

1 Billion In Covid Relief Aid Is Tied Up In Harrisburg Whyy

Home Made Mask Guidance Union County Commissioners

Free Masks Offered At Lancaster Covid 19 Awareness Event Set For Aug 28 29 Local News Lancasteronline Com

Union County Covid 19 Information Page Union County Commissioners

Gov Wolf Sec Of Health Signs Expanded Mask Wearing Order

Home Made Mask Guidance Union County Commissioners

Covid 19 Information Center For The City Of Hermitage Hermitage Pa

Post a Comment for "Are Covid Masks Taxable In Pa"