Are Face Masks Taxable In Pennsylvania

The lawsuit says protective face masks sold during the COVID-19 pandemic fall under two sales tax exemptions in Pennsylvania. The Pennsylvania Department of Revenue DOR has provided updated guidance on the taxability of masks and ventilators on its website to indicate that cloth face masks are now exempt from Pennsylvania sales tax.

Most people know the rules about food and clothing generally being exempt but state law details hundreds of.

Are face masks taxable in pennsylvania. And publication of the list of taxable and exempt. Face masks are also exempt in Pennsylvania. The following purchases are subject to sales or use tax.

Disposable face masks are also exempt from Pennsylvania sales tax. Failing to collect sales tax could leave them paying sales tax out of pocket. Cloth Face Masks are Exempt from Pennsylvania Sales Tax.

Pennsylvanias sales tax can be very confusing. In the complaint attorneys argue these retailers disregarded the April ruling that protective face masks that are sold at retail are exempt from Pennsylvania sales tax. DEPARTMENT OF REVENUE Notice of Taxable and Exempt Property 28 PaB.

The order comes almost three weeks after Gov. Prior to the coronavirus COVID-19 pandemic non-medical masks and face coverings were subject to sales tax because nonmedical masks and face coverings. Items you use to operate your business are taxable unless an exemption applies.

The Pennsylvania Department of Revenue has issued a sales tax bulletin regarding the sales tax treatment of non-medical masks and face coverings. Bunting and other flags are taxable. Code 521 and 581 relating to purchases of medicines medical supplies medical equipment and prosthetic or therapeutic devices.

Taxable Purchases and Use Tax. For these businesses its vital that they be sure they are taxing or not taxing products correctly. Generally you should be collecting tax on sales of face masks unless they are sold to a non-profit organization such as a hospital.

If you are purchasing a scarf or bandana to use as a face covering those items are considered clothing and will not be taxed unless the purchase price of an individual item is more than 17500. Tom Wolf asked but. But when they pivot to making masks they are then required to collect that states sales tax.

Property used for the personal comfort convenience or use of employes shall be subject to tax. Code 521 and 581 relating to purchases of medicines medical supplies medical equipment and prosthetic or therapeutic devices. Prior to COVID-19 non-medical masks and face coverings were subject to sales tax because non-medical masks and face coverings were generally classified as ornamental wear or clothing.

2730 The Department of Revenue is hereby giving notice to the public in accordance with the provisions of 61 Pa. Prior to the COVID-19 pandemic masks sold at retail were typically taxable. According to the 41-page lawsuit in the Allegheny County Court of Common Pleas face masks were declared exempt from Pennsylvania sales tax during the emergency disaster declaration issued by Governor Tom Wolf on March 6 2020 and that exemption.

The medical supplies exemption which includes tangible personal property for use in alleviation or treatment of injury illness disease or incapacity and the clothing exemption which includes articles including vesture wearing apparel raiments garments. Pennsylvania Exempts Non-Medical Masks and Face Coverings from Sales Tax. Asbestos suits 17 31 gloves aprons boots masks helmets goggles and similar items Flags of the US.

Retailers Information Guide REV-717. Sales of medical devices are exempt from the sales tax in Pennsylvania. And publication of the list of taxable and exempt tangible personal.

7256 Saturday December 26 2009 The Department of Revenue Department is hereby giving notice to the public in accordance with the provisions of 61 Pa. Several services are also taxable. According to a Pennsylvania Department of Revenue notice dated October 30 2020 Prior to the COVID-19 pandemic masks sold at retail were typically subject to Pennsylvania sales tax.

Pennsylvania is requiring shoppers and workers at essential stores to wear face masks in public starting at 8 pm. Taxable and Exempt Property 39 PaB. According to the Pennsylvania Department of Revenue protective face masks sold at retail are exempt from state sales tax based on the governors emergency disaster.

However protective equipment such as face masks helmets gloves coveralls goggles and the like worn by production personnel shall be exempt from tax. If you do not pay sales tax on a taxable purchase then use tax is due.

Clear Panel Face Mask With Adjustable Straps Abram S Nation

Being Fooled Or Not By Hyperrealistic Masks When Five Blimps Can Reveal The Dark Knight Psychonomic Society Featured Content

Vwr Maximum Protection Cleanroom Face Masks Vwr

Clear Panel Face Mask With Adjustable Straps Abram S Nation

Lancaster Passes Ordinance Making It Misdemeanor To Violate Face Mask Rule Amid Spike In Covid 19 Cases Ktla

Class Action Lawsuits Take Aim At Retailers Charging Sales Tax On Face Masks During Covid 19 Pennsylvania Record

Are Face Masks Exempt During Sales Tax Holidays

Search The Collection The Metropolitan Museum Of Art Animal Face Mask Art Metropolitan Museum Of Art

Covid Latest It May Be Time To Relax Indoor Face Mask Mandates Dr Anthony Fauci Says 6abc Philadelphia

Trump 2020 Make Liberals Cry Again Face Mask 10 Pack

Watch Adults Film Themselves Attacking Kids For Wearing Masks Just Like Tucker Carlson Said To Raw Story Celebrating 17 Years Of Independent Journalism

Get My Art Printed On Awesome Products Support Me At Redbubble Rbandme Https Www Redbubble Com I Mask Pittsburgh Steel City F In 2021 Mask Polyester Outer Sabrina

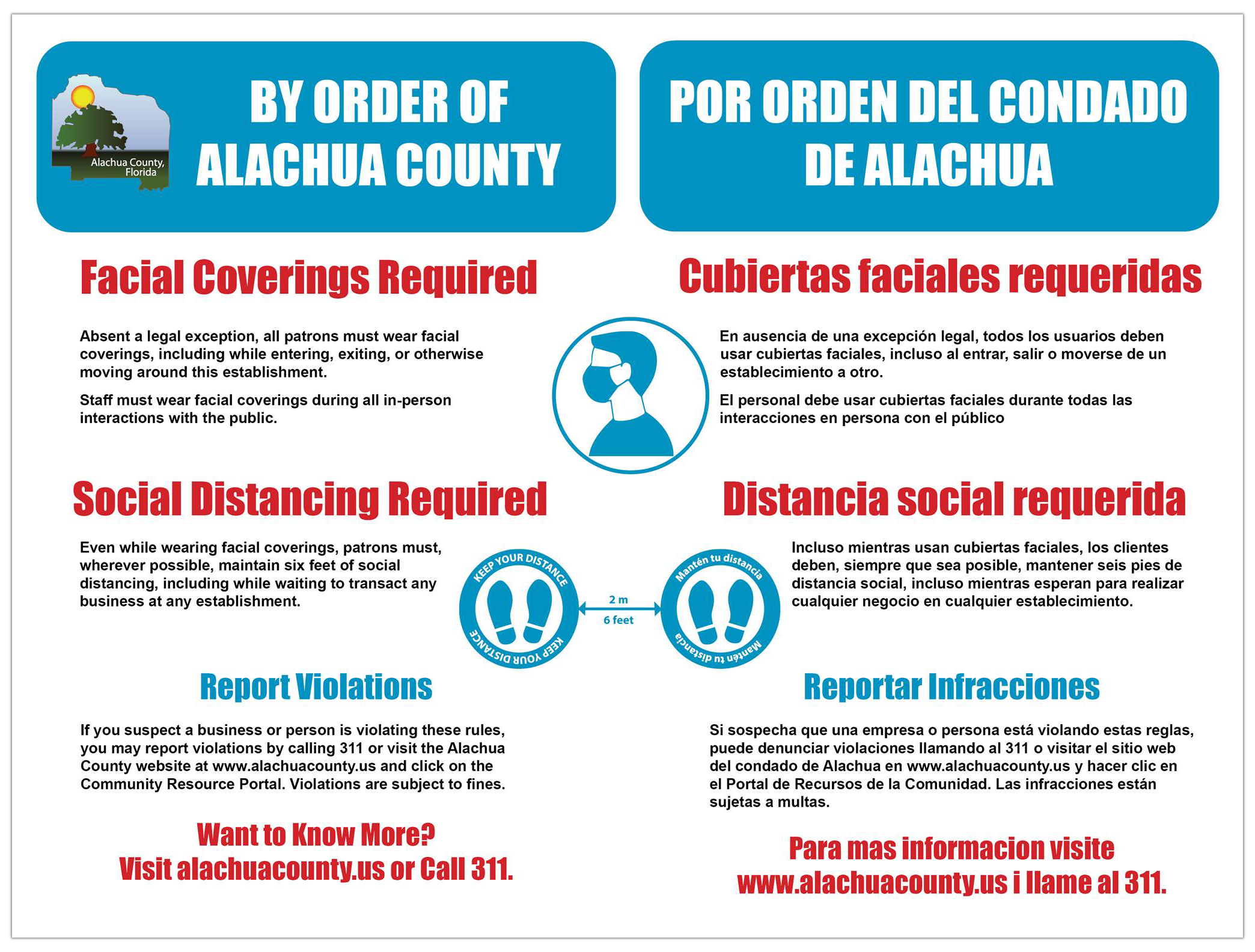

Facial Covering Signs Required Beginning July 1 Letreros De Recubrimientos Faciales Requeridos Comenzando El 1 De Julio

Clear Panel Face Mask With Adjustable Straps Abram S Nation

Post a Comment for "Are Face Masks Taxable In Pennsylvania"